In the aftermath of the 2008 financial crisis, few stories have captivated audiences quite like “The Big Short.” At the heart of this gripping tale stands Mark Baum, a character whose razor-sharp wit and prophetic insights into the housing market crash transformed him into an unlikely hero.

But who is Mark Baum, really? Let’s embark on a deep dive into the world of high-stakes finance, Hollywood adaptations, and the man who saw the impending economic disaster when others turned a blind eye.

Mark Baum: The Catalyst of Financial Chaos in The Big Short

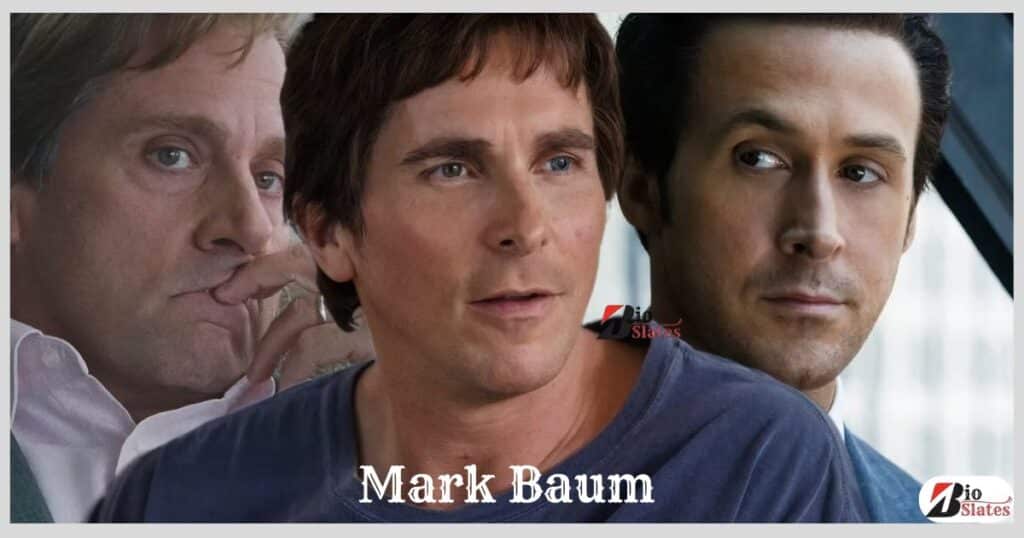

The Big Short, a 2015 film directed by Adam McKay, compellingly illustrates the 2008 financial crisis. Based on Michael Lewis’s bestselling book, the movie follows a group of financial outsiders who anticipated the collapse of the US housing market and strategically “shorted” it.

At the center of this turmoil is Mark Baum, played by Steve Carell. Baum serves as a cynical yet relatable guide through the complex realms of subprime mortgages and collateralized debt obligations (CDOs). His character reflects the outrage and disbelief felt during the crisis, making him a pivotal figure in the narrative.

Key Characters in The Big Short:

- Mark Baum (Steve Carell): The outspoken hedge fund manager leading the charge against the corrupt financial system.

- Michael Burry (Christian Bale): The eccentric investor who first identifies the flaws in the housing market.

- Jared Vennett (Ryan Gosling): The savvy trader who facilitates the shorts.

- Ben Rickert (Brad Pitt): The reclusive former banker providing crucial insights.

The Big Short stands out for its ability to simplify complex financial concepts through clever metaphors, celebrity cameos, and dark humor. The film serves as a critical examination of the factors leading to the 2008 crisis, showcasing how a few perceptive individuals unveiled the vulnerabilities in the American financial system.

Mark Baum: Where Fiction Meets Wall Street Reality

In the cinematic universe of “The Big Short,” the character Mark Baum emerges as a brash hedge fund manager with a chip on his shoulder the size of Manhattan. With an uncanny ability to sniff out financial deception, he’s like a bloodhound on Wall Street. Baum’s outspoken nature and willingness to call out Wall Street’s elite for their transparent follies make him a standout character. But here’s the twist: Mark Baum isn’t entirely real.

Instead, he’s a fictionalized representation of Steve Eisman, a real-life hedge fund manager. The character captures Eisman’s essence and experiences but with Hollywood-style embellishments for dramatic flair.

Why the Name Change?

It’s common in film adaptations to alter names, primarily for legal reasons or to grant filmmakers creative freedom. This name change allows “The Big Short” to take artistic liberties with Eisman’s story while staying true to its core message. By transforming Steve Eisman into Mark Baum, the filmmakers craft a narrative that resonates with audiences, highlighting the critical themes of financial collapse and the ethical dilemmas faced by those within the industry.

In summary, Mark Baum serves as a powerful conduit for exploring Wall Street’s reality, making “The Big Short” a compelling watch for anyone interested in finance, investing, and the consequences of economic greed.

| Category | Details |

|---|---|

| Character Name | Mark Baum (Fictionalized representation of Steve Eisman) |

| Actor | Steve Carell |

| Film Title | The Big Short |

| Release Year | 2015 |

| Director | Adam McKay |

| Based On | “The Big Short” by Michael Lewis |

| Key Characters | Mark Baum, Michael Burry, Jared Vennett, Ben Rickert |

| Eisman’s Birth Year | 1962 |

| Eisman’s Education | University of Pennsylvania (Undergraduate), Harvard Law School (J.D.) |

| Career Start | Corporate Lawyer, then Equity Analyst |

| Pivotal Bet | Shorting subprime mortgage-backed securities |

| Fund | FrontPoint Partners |

| Estimated Fund Gains | Hundreds of millions of dollars |

| 2007 Fund Return | Up to 80% |

| Post-Crisis Advocacy | Stronger financial regulations |

| Major Legislative Impact | Dodd-Frank Act, Consumer Financial Protection Bureau |

| Cultural Impact of Film | Raised public awareness of financial concepts |

| Eisman’s Current Role | Portfolio Manager at Neuberger Berman, Public Speaker |

| Market Concerns | Ongoing risks in housing markets, cryptocurrency, and shadow banking |

Mark Baum (Steve Eisman): The Visionary Behind the Big Short

To truly understand Mark Baum, the fictional character from “The Big Short,” we need to delve into the life of Steve Eisman. Born in New York City in 1962, Eisman was raised in a family deeply rooted in finance; both of his parents worked at Oppenheimer & Co., laying the groundwork for his future career in the cutthroat world of Wall Street.

Mark Baum (Steve Eisman) Educational Background

- Graduated from the University of Pennsylvania

- Earned his J.D. from Harvard Law School

Eisman’s career trajectory began as a corporate lawyer before transitioning to an equity analyst role. He eventually landed at FrontPoint Partners, a hedge fund unit of Morgan Stanley, where he would make a pivotal bet that not only defined his career but also inspired the character of Mark Baum in “The Big Short.”

Mark Baum (Steve Eisman) Unique Personality

What truly sets Steve Eisman apart in the world of finance is his bold personality. Often described as brash, outspoken, and fiercely intelligent, he has built a reputation for his no-nonsense approach and willingness to challenge conventional wisdom. These defining traits played a crucial role in his analysis of the subprime mortgage market leading up to the 2008 financial crisis.

Eisman famously stated, “I’m not an optimist. That’s not my nature. I was born pessimistic.” This inherent pessimism, combined with his exceptional analytical skills, enabled him to see the signs of an impending crisis that many others overlooked. His unique perspective allowed him to navigate the complexities of the financial landscape, making critical predictions about market collapses.

The Importance of Understanding Eisman

In summary, grasping the essence of Steve Eisman is essential for fully understanding the character of Mark Baum and the broader narrative presented in “The Big Short.” Eisman’s sharp insights into the financial world provide a compelling backdrop to the film’s exploration of the factors leading to the financial collapse. His ability to identify flaws in the system exemplifies the critical mindset required in the ever-evolving landscape of Wall Street.

Eisman’s PiVotal Role in Predicting the Housing Bubble

Steve Eisman’s journey to becoming a pivotal figure in the 2008 financial crisis began with a hunch and a commitment to old-fashioned legwork. Unlike many of his Wall Street peers, who often relied on ratings agencies and official reports, Eisman sought to understand the subprime mortgage market firsthand.

Mark Baum (Steve Eisman): Unconventional Research Methods

Eisman employed several unconventional research methods that set him apart:

- Visiting subprime lenders in person

- Talking to mortgage brokers and homeowners

- Analyzing loan data with meticulous attention to detail

What he uncovered was shocking: the subprime mortgage market was built on a shaky foundation. Lenders were issuing loans to individuals who couldn’t afford them, then packaging these high-risk loans into securities that appeared safe.

Eisman’s Key Insights

Eisman’s research led to several critical insights:

- Many subprime borrowers were doomed to default.

- The ratings agencies were asleep at the wheel, failing to recognize the risk.

- The entire financial system was exposed to significant vulnerabilities.

Armed with this knowledge, Eisman made the audacious decision to short the housing market. He bet against subprime mortgage-backed securities, effectively wagering that the entire financial system would collapse under the weight of its unsustainable practices.

Steve Carell’s Portrayal: When Hollywood Meets Wall Street

Steve Carell’s performance as Mark Baum—the fictionalized version of Steve Eisman—is a powerful display of righteous anger and moral indignation. But how closely does it align with the real Eisman?

Similarities Between Carell’s Portrayal and the Real Eisman

Carell’s portrayal shares several key similarities with Eisman:

- Blunt, No-Nonsense Attitude: Carell captures Eisman’s directness and refusal to sugarcoat the truth.

- Fierce Intelligence and Analytical Mind: The character reflects Eisman’s sharp intellect and ability to dissect complex financial issues.

- Moral Outrage at Wall Street’s Excesses: Carell effectively conveys Eisman’s deep frustration with the ethical lapses and excesses of the financial industry.

Hollywood’s Dramatic Touch

However, as is often the case in Hollywood, some aspects of Carell’s character were amplified for dramatic effect. While the real Eisman is certainly outspoken, he is not as prone to public outbursts as his on-screen counterpart.

Eisman’s Praise for Carell’s Performance

Eisman himself has praised Carell’s portrayal, noting that it successfully captures the essence of his personality and his critical role in the financial crisis. Carell’s performance effectively conveys Eisman’s frustration with the financial system and his relentless determination to expose its flaws.aws.

The Big Short’s Impact: Before, During, and After the Crisis

The story of Steve Eisman and his significant short against the housing market goes beyond mere financial strategy. It raises profound questions about our economic system and the ethics surrounding profiting from a crisis that impacted millions of lives.

Eisman’s Financial Gains

While exact figures are challenging to ascertain, it’s estimated that Eisman’s fund, FrontPoint Partners, generated hundreds of millions of dollars from their bets against the housing market. Notably, the fund achieved returns of up to 80% in 2007 alone, highlighting the substantial financial success of this high-stakes gamble.

The Moral Quandary

However, this windfall came at a significant cost. Eisman himself has acknowledged the harsh reality that his success meant millions of Americans were losing their homes and life savings. This moral dilemma is central to “The Big Short,” prompting viewers to confront the complex ethics of profiting during a financial crisis.

Personal Transformation

The experience profoundly changed Eisman. Although he had always harbored skepticism towards Wall Street, the crisis reinforced his worst fears about the financial system’s integrity. In the years following the collapse, Eisman has emerged as an outspoken advocate for financial reform and increased regulation, highlighting the need for greater accountability within the industry.

Mark Baum (Steve Eisman): Post-Big Short Career and Global Influence

After the 2008 financial crisis, Steve Eisman didn’t rest on his laurels. Instead, he continued to navigate the finance world with a renewed perspective and a heightened public profile.

Key Career Moves

- Left FrontPoint Partners in 2011.

- Founded Emrys Partners, which closed in 2014.

- Joined Neuberger Berman as a portfolio manager in 2014.

Beyond finance, Eisman has become a prominent speaker and commentator on market dynamics, even testifying before Congress on financial regulation. His insights into market risks remain influential.

Evolving Views and Warnings

Eisman’s skepticism toward Wall Street persists, particularly regarding cryptocurrency, which he likens to the subprime mortgage crisis in terms of hype and risk. Recently, he has also highlighted potential vulnerabilities in the Canadian housing market and warned of another possible financial crisis.

Mark Baum (Steve Eisman): Shaping Finance Today

Eisman’s journey, epitomized by the character of Mark Baum in “The Big Short,” has significantly impacted both popular culture and finance.

Contributions to Financial Reform

- Advocated for stronger bank regulations.

- Emphasized the dangers of excessive leverage.

- Promoted greater transparency in financial markets.

His story has raised public awareness of complex financial issues, making concepts like mortgage-backed securities and credit default swaps more accessible to a broader audience. Eisman’s influence continues to inspire a new generation of investors and reform advocates.rs and financial analysts to question conventional wisdom and look deeper into the mechanics of financial markets.

Mark Baum (Steve Eisman): Key Lessons from Wall Street

The story of Steve Eisman, portrayed as Mark Baum in “The Big Short,” offers invaluable lessons for investors, regulators, and the general public:

Question Conventional Wisdom

Eisman’s success stemmed from his ability to challenge the status quo. In a world often dominated by groupthink, his skepticism and willingness to dig deeper proved crucial in identifying systemic issues.

Importance of Thorough Research

Eisman didn’t rely solely on reports and ratings; he investigated the subprime mortgage market firsthand. This hands-on approach provided insights that many of his peers overlooked, highlighting the need for diligent research.

The Power of Individual Voices

Eisman’s journey demonstrates that one person asking the right questions can expose significant problems and drive change. His story emphasizes how individuals can impact powerful institutions.

Ethical Decision-Making in Finance

Profiting from a crisis raises complex moral questions. Eisman’s experience compels us to confront the ethical implications of financial decisions, even when they align with the truth.

Need for Strong Financial Regulation

The 2008 crisis revealed serious flaws in our financial system, many of which persist. Eisman’s advocacy for stronger regulations underscores the ongoing need for oversight in the financial sector to prevent future crises.

The 2008 Financial Crisis: A Perfect Storm of Greed and Ignorance

The 2008 financial crisis was more than a housing bubble; it was a perfect storm of misaligned incentives and regulatory failures. Key factors included the deregulation of the financial industry and the rise of complex financial instruments like CDOs.

Predatory lending practices in the subprime mortgage market and the failure of ratings agencies to assess risk also contributed. Furthermore, the “too big to fail” mentality of major institutions heightened the systemic risk. Steve Eisman was one of the few who recognized how these elements were interconnected, understanding the looming disaster.

The Aftermath: How “The Big Short” Changed Wall Street

The 2008 crisis resulted in the greatest economic downturn since the Great Depression, leading to significant industry changes. Regulatory reforms included the Dodd-Frank Act and the creation of the Consumer Financial Protection Bureau.

There was also a rise in public skepticism toward financial institutions and increased demand for transparency. Additionally, enhanced capital requirements for banks emerged alongside the growth of fintech solutions. Steve Eisman’s insights played a crucial role in advocating for these necessary reforms.

Mark Baum (Steve Eisman): Relevance in Finance Today

Years after the 2008 crisis, Steve Eisman remains an influential voice in finance, with his warnings about systemic risks continuing to resonate. Recent concerns include the rise of passive investing and its impact on market stability, as well as the growth of the shadow banking system. He also highlights ongoing risks in certain housing markets.

Eisman’s keen ability to identify potential bubbles makes him a crucial figure in navigating today’s complex financial world.rld. His story serves as a reminder of the importance of critical thinking and thorough analysis in finance.

Mark Baum (Steve Eisman): Cultural Impact of The Big Short

“The Big Short” didn’t just tell Eisman’s story; it made finance accessible and engaging to a broad audience. The film’s success sparked a renewed interest in financial storytelling:

- Similar financial dramas:

- “Margin Call” (2011)

- “Too Big to Fail” (2011)

- “The Wolf of Wall Street” (2013)

- Documentaries inspired by the crisis:

- “Inside Job” (2010)

- “Capitalism: A Love Story” (2009)

These films, along with “The Big Short,” have played a crucial role in educating the public about complex financial issues and the potential consequences of unchecked greed on Wall Street.

Mark Baum (Steve Eisman): Methodology for Modern Risk Analysis

Steve Eisman’s approach to analyzing the housing market offers valuable lessons for modern investors and risk managers:

- Look beyond the numbers: Eisman didn’t just rely on financial statements; he talked to people on the ground.

- Question everything: He wasn’t afraid to challenge conventional wisdom or ask uncomfortable questions.

- Understand the incentives: Eisman realized that misaligned incentives were at the heart of the subprime crisis.

- Consider systemic risks: He saw how problems in one area could cascade through the entire financial system.

- Be willing to go against the crowd: Eisman’s biggest gains came from taking positions contrary to the market consensus.

These principles continue to be relevant in today’s complex financial landscape, where new technologies and financial products create both opportunities and risks.

Mark Baum (Steve Eisman): Ethics of Shorting in Crisis

Steve Eisman’s story, particularly his role in the 2008 financial crisis, raises significant ethical questions about shorting—profiting from a market disaster. While Eisman accurately identified critical flaws in the housing market, his financial gains occurred amidst widespread economic suffering.

Arguments in Favor of Shorting:

- Market Correction: Shorting can serve as a mechanism for correcting overvalued markets, helping restore balance.

- Fraud Exposure: It can uncover fraudulent practices or identify companies that are overvalued, promoting transparency.

- Increased Liquidity: Short selling adds liquidity to financial markets, facilitating smoother transactions.

Arguments Against Shorting:

- Market Downturns: Shorting may exacerbate market downturns, leading to deeper economic consequences.

- Manipulation Risks: It could create incentives for market manipulation, undermining investor trust.

- Negative Perception: Shorting is often viewed as “betting against” companies or the overall economy, which can be seen as unethical.

Eisman himself has wrestled with these ethical dilemmas. While he defends his actions as justified, he also recognizes the moral complexity inherent in profiting from a crisis that devastated many lives.

Conclusion

The journeys of Steve Eisman and Mark Baum highlight the power of individual insight and the need to challenge prevailing narratives. Their experiences serve as a cautionary tale about financial excess and the ethical complexities of the financial system.

As we face an increasingly intricate financial landscape, the principles of skepticism, thorough research, and ethical consideration remain essential. The lessons from “The Big Short” remind us that clarity and truth-telling are vital in navigating financial markets. With voices like Eisman’s advocating for transparency, we can better prepare for future crises and foster a more accountable financial environment.